Singapore Budget 2025February 25, 2025What do you need to know about Singapore Budget 2023? See our summary BudgetInsights budget,insights, Get in touchWhatever your question our global team will point you in the right directionStart the conversationSign up for HLB insights newsletters Email Address* By submitting your email address, you acknowledge that you have read the Privacy Statement and that you … Read More

Employers Taken to Task for Abusing Jobs Support Scheme

The Inland Revenue Authority of Singapore (IRAS) has taken actions against employers who have attempted to abuse the Jobs Support Scheme (JSS). It has denied JSS payouts either partially or fully to 444 employers. IRAS has also referred egregious cases to the Police for investigations.

Fortitude Budget

Announced by Mr Heng Swee Keat, Deputy Prime Minister and Finance Minister, in Parliament on 26 May 2020. This supplementary budget draws a further S$31 billion from past reserves for Singapore’s fourth budget this year 2020 to further support firms, save jobs and create jobs.

Overview of GST e-Filing Process

GST-registered businesses are required to use CorpPass to e-File their GST returns through myTax Portal and make payment to IRAS by the due date.

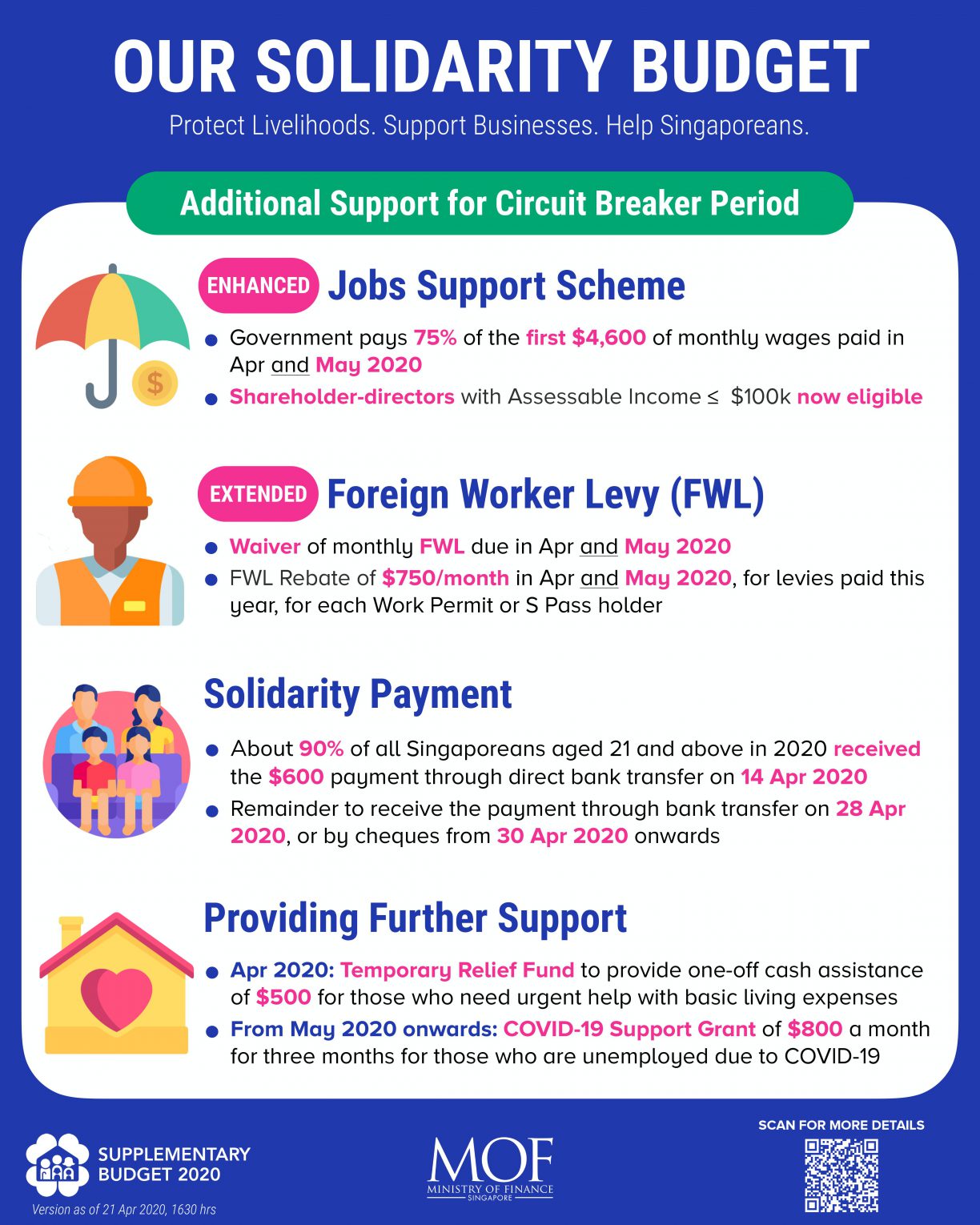

Government to Continue Support Measures to Protect Livelihoods and Stabilise Businesses During Extended Circuit Breaker Period

Jobs Support Scheme at 75% in May, now covers shareholder-directors Foreign Worker Levy Waiver and Rebate extended by one month Applications for COVID-19 Support Grant starts from 1 May 2020

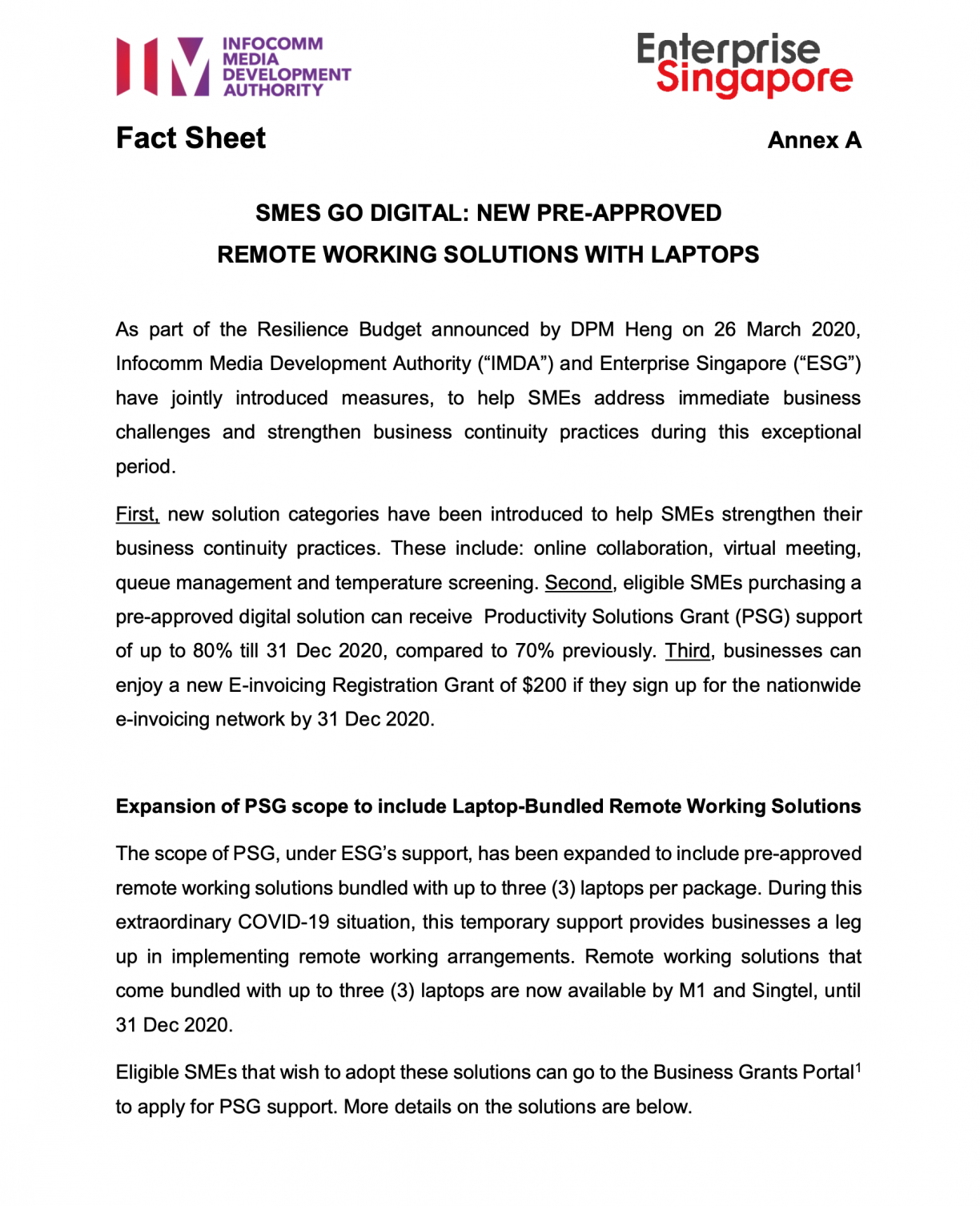

SMES GO DIGITAL: NEW PRE – APPROVED REMOTE WORKING SOLUTIONS WITH LAPTOPS

As part of the Resilience Budget announced by DPM Heng on 26 March 2020, Infocomm Media Development Authority (“IMDA”) and Enterprise Singapore (“ESG”) have jointly introduced measures, to help SMEs address immediate business challenges and strengthen business continuity practices during this exceptional period

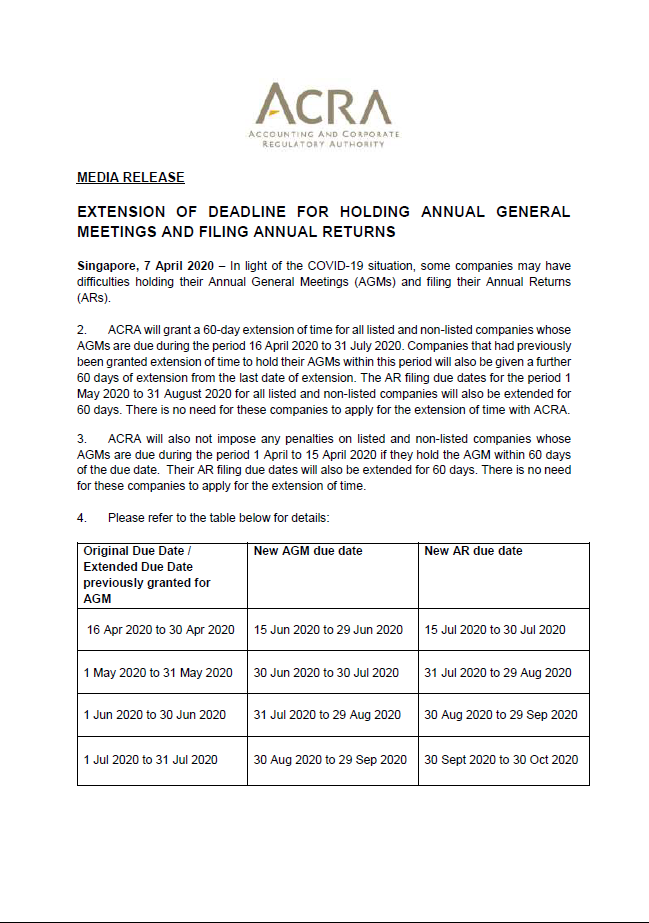

ACRA – MEDIA RELEASE : EXTENSION OF DEADLINE FOR HOLDING ANNUAL GENERAL MEETINGS AND FILING ANNUAL RETURNS

ACRA’s Support Measures and Guidance for Businesses during COVID-19

- Page 1 of 2

- 1

- 2